1. Overview

Framesoft Contract Repository (FCR) is a dynamic application for Legal, Documentation, Credit and Treasury functions. It enables financial institutions engaged in OTC Derivatives; REPO and Security Lending transactions to maximize the value of all information contained within (Master) Agreements, such as close-out nettings provisions and associated Collateral Arrangements.

FCR supports a 360-degree management of any corporate agreement during its entire lifecycle.

By translating complex yet qualitative information into centrally managed, usable, referenceable data, FCR will accurately generate the fundamental parameters for netting, both enhanced Credit Line Management and Regulatory Capital Relief. In this way, FCR facilitates sound management of Credit, Legal and Operational Risks for Legal, Documentation and Credit Risk functions across institutions.

Framesoft Contract Repository (FCR) supports leading Banks and Security Houses in managing and evaluating information on thousands of Master & Collateral Agreements globally, whilst also taking account of multi branch relationships between both parties, products traded, and jurisdictions relevant for determining the “Nettability” of transactions.

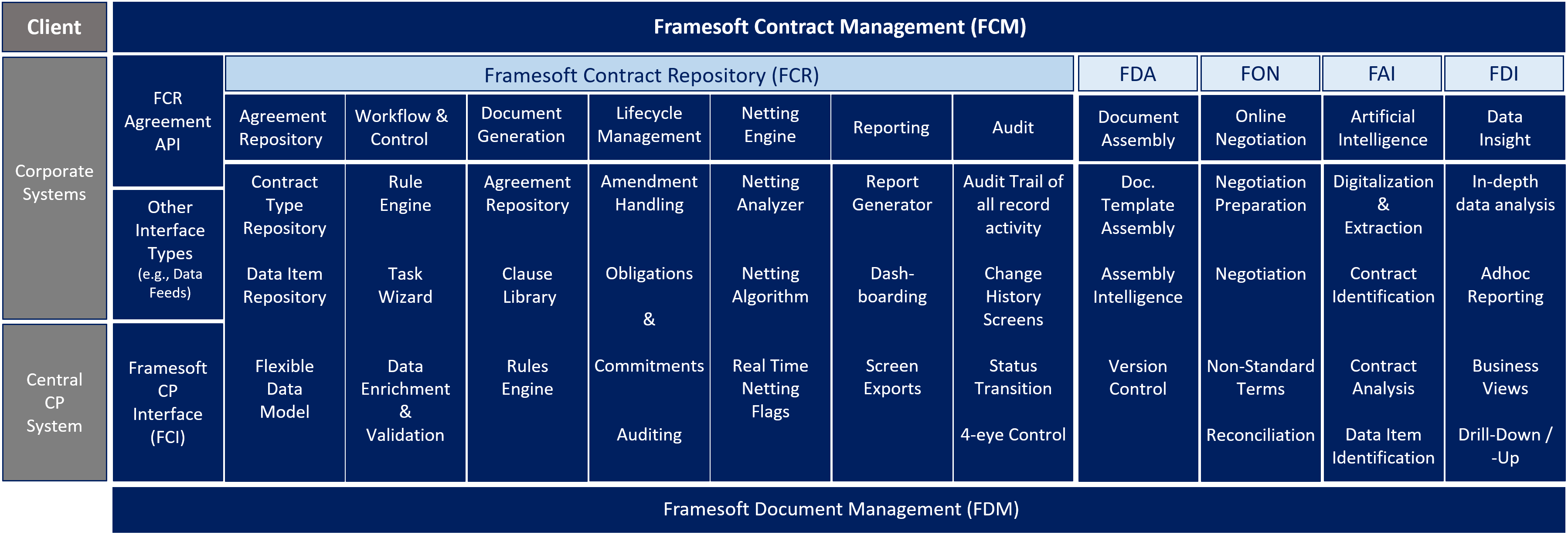

The Framesoft Contract Repository (FCR) is the core component of the Framesoft’s Contract Management Solution Suite.

Framesoft’s Contract Management allows companies to gain control of all contracts and associated privileges & obligations. With Framesoft Contract Management, all corporate professionals dealing with mission critical contract documents have immediate access and visibility into contracts across the enterprise, resulting in elimination of operational risks, acceleration of processes, instant management control and compliance with guidelines and regulatory requirements. Even external parties may be fully integrated in all relevant steps of the workflow associated with mission critical contracts.

These advantages are derived from a fully integrated set of applications combined in the Framesoft Contract Management Suite, covering the complete lifecycle of any contract or other business document:

- Realtime creation & configuration of document templates via Framesoft Document Assembly (FDA)

- Automatic Generation of documentation such as first draft, execution copy, etc. via Framesoft Document Generator (FDG)

- Secure Intranet or Internet Negotiation and Collaboration via Framesoft Online Negotiation (FON)

- Agreement & Data (Risk) Analysis and Management Reporting via Framesoft Data Insight (FDI)

- Creation and / or updates of agreements / annexes triggered by external sources via FCR Agreement API

- Counterparty updates & handling of new counterparties provided by a client's central counterparty system in FCR via Framesoft Counterparty Interface (FCI)

- Tracking the adherence to protocols on counterparty & agreement level via Framesoft Adherence Protocol (FPA)

- Bringing natural / legal language processing & modern artificial intelligence methods to documents via Framesoft Artificial Intelligence (FAI)

2. The Business Driver

As trading volumes increase and firms both reach their credit limits and increase counterparty exposure and therefore credit risk, the need to collateralize their activities becomes increasingly important. Coupled with the growth in numbers and type of trading counterparties, this needs to collateralize to free up trading lines and reduce exposure becomes critical.

The credit risk mitigation achieved by master and collateral agreements delivers two key business benefits, namely, the opportunity for enhanced credit line management and the potential for obtaining regulatory capital relief. Such relief can be secured by the firm, through having lower exposures to counterparties and thus reducing capital burdens imposed by regulators.

The further reduction of counterparty exposures through collateralization and the potential reduction of actual loss upon default, through legally enforceable close-out netting provisions, are clearly beneficial. However, these techniques, whilst mitigating one form of risk, introduce two other major types of risk: Legal Risk and Operational Risk. In a growing collateralization market, these risks take on new significance. Moreover, the Basel Capital Accord II actively proposes the introduction of capital charges for less than robust management of these risks.

Put simply, the full benefits of mitigated credit risk in today’s regulatory environment can only be realized if legal and operational risks are also managed successfully. Framesoft Contract Repository (FCR) does exactly this.

As the market grows, the need to manage agreements centrally and the ability to scale up and adapt to changing legal and operational requirements is critical. FCR performs these requisite functions and more.

3. Functionality & Key Benefits

The functional elements of Framesoft Contract Repository (FCR) are all designed to enable the successful management and administration of master and collateral agreements from a central point.

This centralized approach to document and data management will become essential in ensuring the execution of truly firm-wide credit risk management strategies, given the changing emphases of regulatory capital allocation regimes. As agreement information is effectively transformed into useable data items, adaptability, flexibility, and scalability are achieved with consummate ease.

FCR builds on these base functional characteristics to improve both communications between front and middle office functions and more specifically, provide the fundamental rules for firm-wide, accurate netting processes. This power and flexibility create a key advantage over incumbent, conventional contract management systems, typically derived from desktop database applications or even spread-sheet based programs. These distributed, hard-to-control, inflexible and therefore unwieldy tactical applications simply will not be able to provide the quality of data management required for the critical reporting and netting process requirements placed upon firms by regulators for proper operational risk control.

FCR not only provides the necessary flexibility, scalability, and quality of data management, but goes on to provide the deliverables of key reporting structures and netting processes themselves.

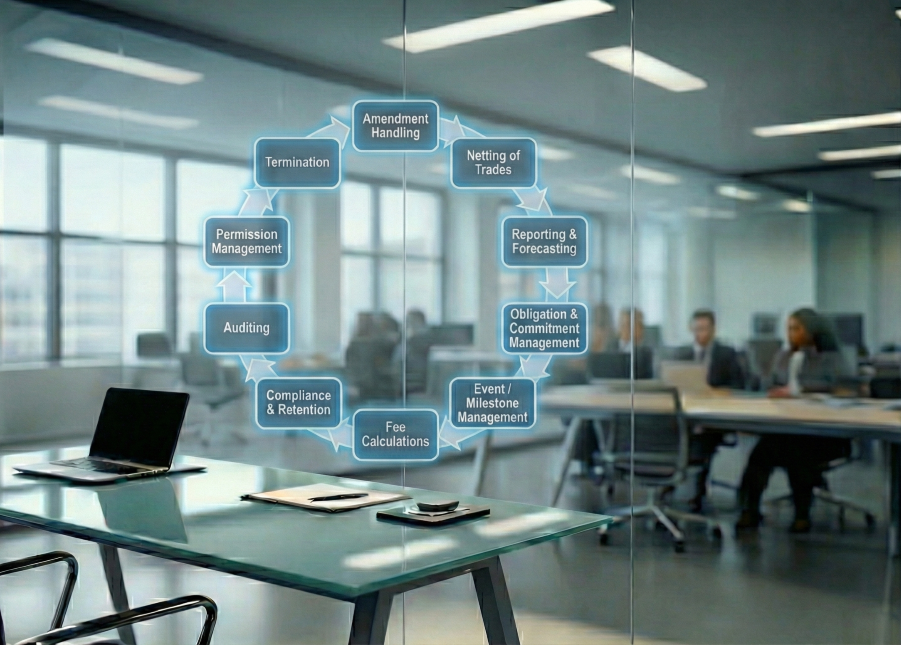

The functionality of FCR is rich and unique. It includes, but is not limited to, the following key processes and actions:

4. Framesoft Contract Repository (FCR) Core Modules

4.1 Agreement Repository

Based on its unlimited flexible data model, FCR supports the setup & design of any agreement / contract type, structured data items & clauses to be stored for contracts & annexes. FCR can be extended at any time to cover any new agreement types or additional details via configuration only. Access privilege restrictions on agreement data based on client entities are also supported in FCR. FCR is able to build and manage additional data items dynamically. This functionality provides the flexibility to handle any new legal, contractual, counterparty type, product, or regulatory requirements. This has proven invaluable to clients, many of whom have needed to respond to changing capital adequacy qualifications by inserting “early termination” clauses across their agreements. The freedom of free configurability of data items is of enormous benefit yet represents only one piece of functionality.

4.2 Workflow Engine

The FCR Workflow Engine is designed to manage, automate, and optimize business processes. It provides a structured approach to handling tasks, approvals, and the flow of information within an organization such as:

- Agreement / Contract Request & Onboarding

- Non-Standard Term (NST) handling

- Legal Opinion

- Approval & Agreement Generation as well as

- Amendment Handling

and offers the following functionalities:

- Process Modelling - allows design & visualize workflows using a graphical interface, defining the sequence of tasks, decision points, and the flow of data.

- Task Management - automates the assignment and tracking of tasks, ensuring they are completed by the right personnel in a timely manner.

- Rule Engine - executes predefined business rules to route tasks, make decisions, and trigger actions based on specific conditions and criteria.

- Integration - it may relate to other enterprise systems (e.g., ERP, CRM, databases) to exchange data, ensuring seamless information flow across different platforms.

- Multi Workflow Integration / Bundling - multiple contracts can be bundled to optimize data entry for all contracts in a single task & separated again upon reaching a defined workflow status (e.g., “Generation of first draft”)

- Notification System - send automated notification messages, e-Mails, alerts, and reminders to users about pending tasks, deadlines, and status changes to keep the process on track.

- Access Control - manages user permissions and roles to ensure that only authorized individuals can perform certain actions or access sensitive information.

- Monitoring and Reporting - Offering visibility into workflow performance, generating reports and analytics on process efficiency, bottlenecks, and compliance. Furthermore, reassignments of workflow tasks can be managed.

- Audit - Complete Workflow History available.

4.3 Document Generation & Editing

Based on the assembled document templates via FDA or FCR template repository, contracts are generated automatically as part of an onboarding workflow, manually or triggered externally. Once the document(s) are generated they can be reviewed, edited and / or passed on for (online) negotiation.

The “Framesoft Docs” document editor supports the generation of documents / contracts based on:

- Mapping Rules

- Document Templates (and its clauses) defined via FDA

- Agreement Data Items

Generated documents are editable, and any document update is tracked via new version / revision. Furthermore, Framesoft Docs supports:

- Global Styles - help to update the overall style across their entire document without having to edit individual blocks, sections, or pages.

- Track Change Mode - for reviews and / or negotiation of documents

- Document Export - in MS Word, MS Excel, or PDF format.

4.4 Contract Event & Lifecycle Management

The primary goal of an effective Contract Event & Lifecycle Management is to streamline and optimize the process of managing contracts from inception through execution to renewal or termination.

FCR’s Contract Event & Lifecycle Management module involves systematic tracking, administration, and maintenance of all contracts to ensure compliance, mitigate risks, and maximize business outcomes.

Contract Event & Lifecycle Management functionalities:

- Reminder / Follow-Up / To Do Lists and Workflows

- Change History Screens

- Netting Flags

- Amendment Handling including Compare Mode

- Status Transition Handling

4.5 Netting Engine

FCR focuses on automated netting decisions based on legal opinions & netting rules. The netting engine scans on demand or automated as batch process FCR to find potentially nettable combinations of customer & counterparty (on branch level) and individual product traded. Based on these netting details risk systems can calculate legally correct netting results & accurate risk figures. It considers liquidation netting based on master agreements, as well as collateral agreements allowing further reduction of risk resulting from trades done that are covered under a CSA. Here again, FCR fully relies on configuration screens. All netting rules are adjustable at any time. It allows reacting immediately on market events. Furthermore, FCR offers all required contract management functionalities from the contract request until its termination. FCR’s workflow engine leads through the process of draft agreement generation, negotiation, approval, and final generation. The final agreement terms are stored in FCR’s highly flexible data model ready to support any agreement type.

- Netting Types, Systems and Netting Rules

Netting types and netting systems are configured in FCR. Each combination might have its own rule set that is pulled once the netting algorithm is started in the corresponding run mode. While liquidation netting is overseeing the master agreements (and annexes) according to the rule set for liquidation purposes, “Collateral Netting” is performing additional checks regarding the collateral enforceability of certain products under certain collateral annexes. In collateral run mode, when a collateral agreement has been identified, first the corresponding master agreement is evaluated to find the main products covered. Based on this result set, the collateral rules are applied, and products might be subtracted from the initial result set. An intersection is applied between the liquidation evaluation of the master and the collateral evaluation of the CSA, which provides the final collateral eligibility matrix. Typically counterparty properties are used to deal with counterparty types. To avoid duplication of data entry, the counterparty types are managed on master agreement level only, but collateral rules are further defined on the counterparty type.

- Netting Algorithm

The netting algorithm is based on the configuration of netting rules in FCR. The FCR netting algorithm processes all agreements for which according to the jurisdiction of the counterparty and agreement type netting rules are in place. Such netting checks are done on the level of the master agreement first. Upon success, available annexes are further evaluated, which potentially add additional products to the master coverage.

- Netting Analyzer

Real time netting evaluation of single agreements, groups of agreements or a free selection of agreements via FCR Netting Analyzer embedded in FCR.

4.6 Search & Reporting

The FCR Search & Reporting Module provides search and reporting functionalities such as:

- FCR Search Screens (e.g., Agreements, Agreement Clauses, Counterparties, Properties, etc.)

- Framesoft Report Generator (FRG) for defining and executing report requests and passing on to FDI

- Export FCR Overview tables in MS Excel directly

- Filtering in FCR Overview tables

- Configure reports as FCR screens

4.7 Audit

The FCR Audit Module provides a comprehensive and tamper-evident audit framework to ensure full transparency, accountability, and compliance across all contract-related activities. It maintains a complete audit trail of all record activity throughout the contract lifecycle, supporting regulatory, security, and operational oversight requirements.

FCR Audit Module`s Core Capabilities

- Activity Tracking & Logging

- Change History & Version Control

- Data Integrity & Tamper-Evidence

- Governance & Control Mechanisms

- Secure Retention & Traceability

via

- Change History Screens

- Status Transition

- 4-eye Control

Furthermore, audit logs are stored securely and retained for complete traceability.

5. FCM Extensions / Add-Ons

To encompass the entire lifecycle of any contract the Framesoft Contract Management (FCM) solution suite offers the following fully integrated extensions / Add-Ons:

- Framesoft FCR Agreement API

- Framesoft Document Assembly (FDA)

- Framesoft Online Negotiation (FON)

- Framesoft Artificial Intelligence (FAI)

- Framesoft Data Insight (FDI)

- Framesoft Counterparty Interface (FCI)

- Framesoft Protocol Adherence (FPA)

Additional Framesoft Solutions seamlessly integrated with FCM

6. FCM Delivery Models

The following FCM delivery & operation models are offered:

- On-Premises Installation

- Client Cloud Installation

- Software-As-A-Service (SaaS)

Interested to see FCM at work - contact us at:

![]()

![]() +41 41 545 37 72

+41 41 545 37 72